EAST Framework: How Behavioural Science Can Transform Marketing

November 13, 2025

5 Min Read

Behavioural science has a lot to teach us about why people buy. The EAST Framework offers a practical lens for…

Read ArticleMay 16, 2025

3 Min Read

Industry

Partner & Co-Founder

Sign up to stay in touch and be the first to hear about our latest business, market and event updates.

Floresco Co-Founder Dan Fallon jumps into global ad spend trends over the last 10 years, and explains what this means for advertisers today.

It’s been a while since I’ve been deep in the day-to-day of a paid media agency, so I thought it was time to take a fresh look at how media spend trends have evolved.

Unsurprisingly, the landscape has changed dramatically during that period. Back in 2010 global digital ad spend made up around 25% of total ad spend. Fast forward to 2025, and in the US, it’s expected to take +75%.

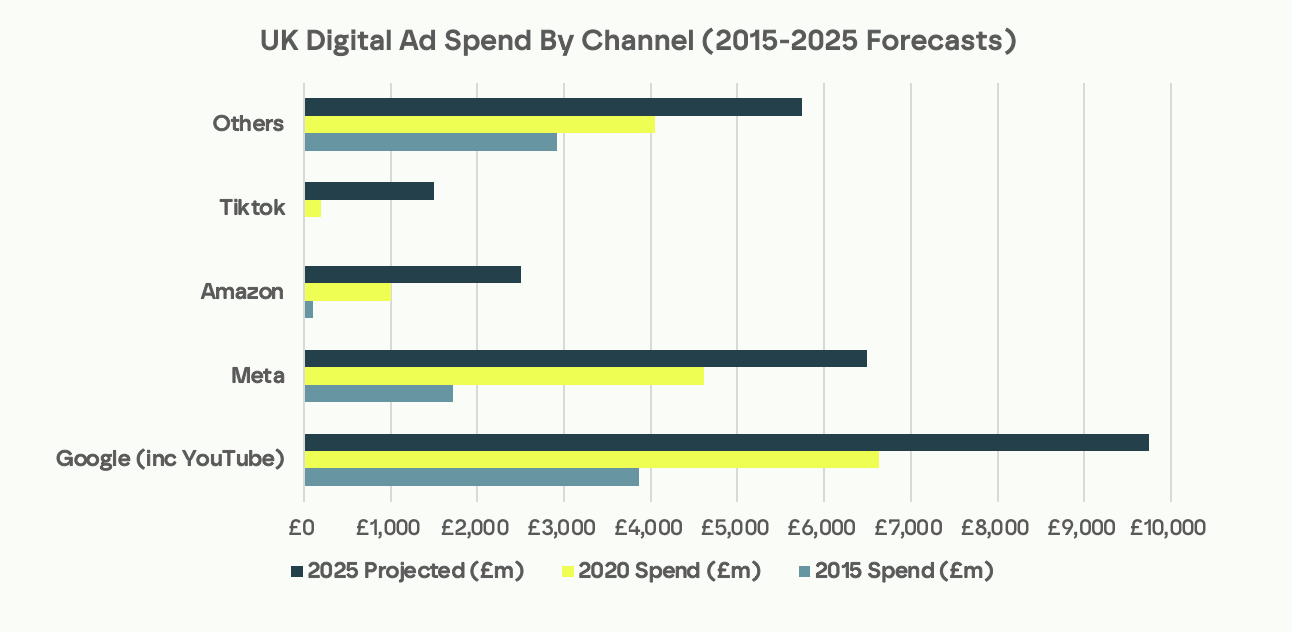

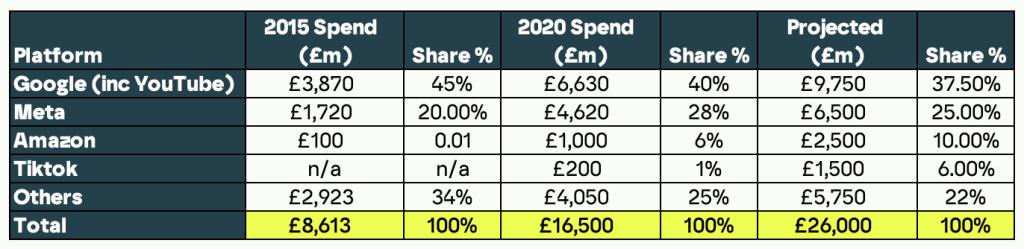

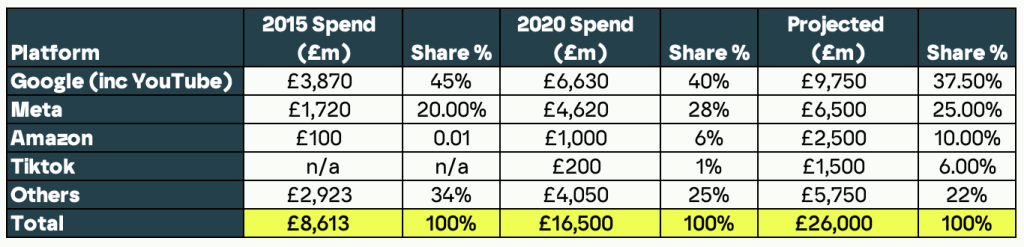

Also in 2010, Google Ads (back then primarily still search), was still the undisputed big beast of digital marketing. Even in 2015, search held over 45% of global digital ad spend vs. around 30% now. Meanwhile, social and video platforms have exploded. Meta now commands over 20% of global digital ad dollars, YouTube sits around 10%, and TikTok – virtually irrelevant as a platform five years ago – is projected to surpass $20 billion in global ad revenue this year.

Curious as to what was driving the growth in “Others”, I dug in. No huge surprises here. Back in 2015, this was largely Twitter, LinkedIn, Yahoo and various programmatic networks. Outside western markets, this was predominantly Baidu and Tencent. Moving to 2020 and present day, Snapchat, Pinterest, Reddit, Alibaba and Douyin are also taking major slices of this, especially across APAC.

Diving into the UK, Google and Meta are clearly massively dominant. I was curious Meta wasn’t gaining faster but on investigation, saw YouTube’s rapid growth boosting slightly slower search growth for Google. TikTok and Amazon are clearly growing rapidly, unsurprising.

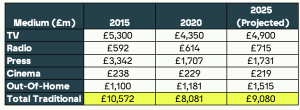

The dominance of Google and Meta becomes even more apparent when we add in “traditional” media and see Google and Meta combined trousering c. 50% of overall UK ad spend!

Traditional channels obviously haven’t kept pace. TV ad spend has broadly plateaued depending how you categorise CTV. Print started its hard fall over a decade ago when Google first rose and devoured its classified ad revenue. Radio listening has shifted into podcasts and music streaming. Outdoor remains more solid with strong investment in digital displays.

Looking ahead, I’m increasingly curious about how AI tools are going to further disrupt the current landscape. My guess is their effect on search (and therefore Google) is going to be dramatic. Categories like travel – I recently planned a holiday with ChatGPT – are perfect for AI assistants as is finance (think about price comparison sites as legacy information formats).

Whilst Google currently outguns ChatGPT and Co in search volume 200:1, globally it’s clear that AI search is growing explosively.

Just this week YouTube has announced it will use Gemini AI to target ads to viewers when they’re most engaged with a video, and we’ve all seen evidence of ChatGPT integrating a checkout feature and shopping results. A range of more integrated ad formats can’t be far off. I’d anticipate 2030’s ad spend stats will be radically different.

If you want to find a paid media agency to help you leverage the latest trends and tech to drive business growth, we’d love to talk.

Sources: Statista, WARC, IAB UK, Advertising Association UK, EMarketer, Netimperative, Campaign, eConsultancy, NewDigitalAge